I have always felt shorting option is a good technique(sellers of hope). But this is not easy for a retail trader whatever might be the reason, maybe the scare of unlimited loss. Holding a stock to its lot size and shorting call 5-7% higher than the current price is one option(plain covered call) but what if the price moves beyond your price we loose on the additional gain which you could have made. Also if the stock falls we loose.

My view is Hold NIFTYBees or start an SIP in NIFTYbees so that the value reaches atleast 2.5lakh (half of full lot value) and then short Nifty call at a higher price say 5% higher at the beginning of the month and continously repeat this every month, if you can take some additional risk can add an additional leg of short put 10-12% lower so the return increases. Nifty return historically of 15*%pa and option shorting another 1+% each month should add 12%pa. So this gives a return of 27%+. A decent return if it can be achieved in the long term.

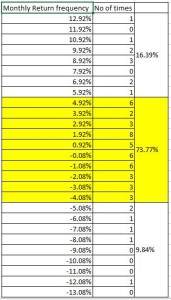

Reason for choosing NiftyBees#(ETF of Nifty): Lower volatility of NIFTY, only 10-12 times in last 60 months Nifty has breached +/-7%. And above 9% in a month is less than 6 times. If you can actively manage the call difference with spot prices to 7% by moving up or down as and when premium drops you could add another 3-5% annually making the average annual return to 30-32%. If you consider adding a short put(requires monitoring on a daily basis) then this could also add another 5% so taking the annual returns to 35-37%. Not a bad one considering mutual fund returns.

Nifty Monthly average returns

This anyway is not for those Hard core traders, but people with lower risk appetite can try this. At one side you make a tax free return from long term investing in Nifty and keep making some smaller profits so that you can add on to your position in Niftybees or elsewhere. The SIP would ensure investment is diversified over time so any potential downside should be taken care off(Time Diversification). With the nature/state of Indian economy we should see some good appreciation on Nifty*.

If a risk loving person feels the return is less than can consider shorting naked option call and put both at a distance higher than 7+% and should continue doing it for the next considerable time period. The longer you follow this strategy more the chances of success.

Disclaimer : This is just for educational purpose and not a recommendation to invest. Option shorting involves

considerable risk and can loose entire invested capital and more. Do consult your investment advisor before considering this strategy.

*Considering historic return of Nifty, it is not a prediction of future return.

#You can choose any other ETF which tracks nifty other than NiftyBees. Or can even look at stocks which move in co-relation with nifty.

Assumptions : Nifty return to be 15% which might not be the case with India becoming a developed country with time.

Image & Nifty Montly returns Courtesy : Hemant Pai

Quite helpful and nice work