Category: Uncategorized

Mother of all Bull market is here…!!!

Its been quite sometime after my last post, and there have been lot of changes around. Trump victory, UP elections BJP winning and slowly complacency around the globe with no major upcoming event. Congratulations!! we are staring at a Mother of all Bull Market Why do i feel we would see a bull market? I Read more about Mother of all Bull market is here…!!![…]

AUM of Indian Mutual Fund industry cruises to a New record high of Rs.16,50,011 Crores in Nov 2016

Indian Mutual Fund industry continued it’s All time High record journey for 5 months in a row to reach Rs.16.50 Lk Crs. Net fund flows: According to the data obtained from AMFI / SEBI, Nov 2016 ended up with a net inflow of Rs.36,021 crs. Equity funds saw a net inflow of Rs.8,068 crs, 2nd Read more about AUM of Indian Mutual Fund industry cruises to a New record high of Rs.16,50,011 Crores in Nov 2016[…]

Great Corporations are Great, because they are Great

Big mighty organisations which have survived the test of time are great because they are great, sounds obvious isn’t it? Worlds greatest organisations have grown amidst all the adversity they face and even come ahead of competition and maintain there status inspite of all evil. Above statement i made after analyzing Maruti which was a Read more about Great Corporations are Great, because they are Great[…]

Its a bubble, And its going to burst..!!!

First question any investor would ask another investor, what do you feel about the market? You would get different answers to this question depending on his perspective. My answer to the above question, yes we are in a bubble situation and the markets world wide can come tumbling down depending on the extent they are Read more about Its a bubble, And its going to burst..!!![…]

De-Risk the risky option shorting

I have always felt shorting option is a good technique(sellers of hope). But this is not easy for a retail trader whatever might be the reason, maybe the scare of unlimited loss. Holding a stock to its lot size and shorting call 5-7% higher than the current price is one option(plain covered call) but what if the price moves beyond your price we loose on the additional gain which you could have made. Also if the stock falls we loose.

My view is Hold NIFTYBees or start an SIP in NIFTYbees so that the value reaches atleast 2.5lakh (half of full lot value) and then short Nifty call at a higher price say 5% higher at the beginning of the month and continously repeat this every month, if you can take some additional risk can add an additional leg of short put 10-12% lower so the return increases. Nifty return historically of 15*%pa and option shorting another 1+% each month should add 12%pa. So this gives a return of 27%+. A decent return if it can be achieved in the long term.

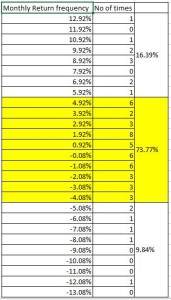

Reason for choosing NiftyBees#(ETF of Nifty): Lower volatility of NIFTY, only 10-12 times in last 60 months Nifty has breached +/-7%. And above 9% in a month is less than 6 times. If you can actively manage the call difference with spot prices to 7% by moving up or down as and when premium drops you could add another 3-5% annually making the average annual return to 30-32%. If you consider adding a short put(requires monitoring on a daily basis) then this could also add another 5% so taking the annual returns to 35-37%. Not a bad one considering mutual fund returns.

Nifty Monthly average returns

This anyway is not for those Hard core traders, but people with lower risk appetite can try this. At one side you make a tax free return from long term investing in Nifty and keep making some smaller profits so that you can add on to your position in Niftybees or elsewhere. The SIP would ensure investment is diversified over time so any potential downside should be taken care off(Time Diversification). With the nature/state of Indian economy we should see some good appreciation on Nifty*.

If a risk loving person feels the return is less than can consider shorting naked option call and put both at a distance higher than 7+% and should continue doing it for the next considerable time period. The longer you follow this strategy more the chances of success.

Could India Be the First to Get Rid of Cash?

“Black money” — the colloquial name for a vast network of off-the-book cash transactions and unbanked savings — is one of India’s biggest scourges. Amounting to as much as $460 billion a year, bigger than the GDP of Argentina, all that money lies beyond the reach of the tax authorities, creditors and anti-corruption investigators. Efforts Read more about Could India Be the First to Get Rid of Cash?[…]

Brexit done….!! What next for the Indian markets

Now that the Brexit has happened and the world markets bleeding, we need to see how it can impact Indian markets. In the short term there will be volatility and even sectors having exposure to EU would have some weakness. But the stronger companies with good fundamentals will recover. Perform much better hence giving the Read more about Brexit done….!! What next for the Indian markets[…]

Nifty at cross roads

Nifty on 18-March-2016 closed just above 7600, which is a very crucial support for it. Monday’s opening and the next week would be very crucial for both bulls to hold on to the uptrend or will they allow the bears to take control and take Nifty and the market lower. It would be better to Read more about Nifty at cross roads[…]